In the evolving landscape of enterprise software, Salesforce’s capital return strategy has emerged as a focal point for investors seeking to balance growth and shareholder value. With a $50 billion share repurchase program and a 0.7% dividend yield in Q2 2026, the company has signaled its commitment to rewarding shareholders. However, as competitive pressures intensify and market dynamics shift, the question remains: Are these measures sufficient to unlock long-term value?

A Dual-Pronged Approach: Buybacks and Dividends

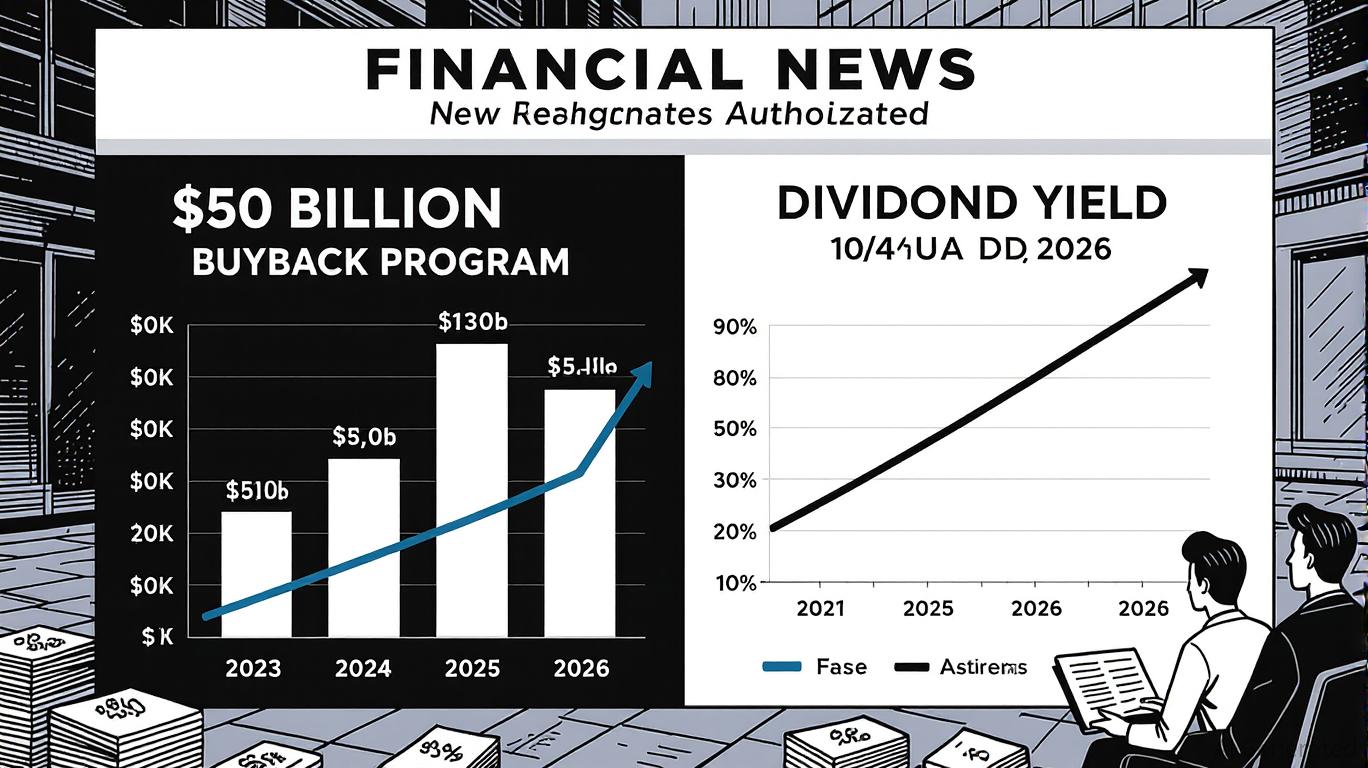

Salesforce’s Q2 2026 results underscored its aggressive capital return strategy. The company returned $2.6 billion to shareholders, including $2.2 billion in share repurchases and $399 million in dividends, while announcing a $20 billion boost to its buyback program—bringing the total authorization to $50 billion [1]. This move reflects confidence in its financial resilience, evidenced by a 10% year-over-year revenue increase to $10.2 billion and a 11% rise in subscription and support revenue [2]. Non-GAAP operating margins expanded to 34.3%, marking a tenth consecutive quarter of margin growth [3].

Yet, the dividend yield of 0.7% remains modest compared to peers like Microsoft and Oracle, which trade at higher valuation multiples [4]. While buybacks can artificially inflate earnings per share (EPS), analysts project Salesforce’s adjusted EPS to grow by 20% in fiscal 2025, trailing ServiceNow’s anticipated 25% increase [5]. This disparity highlights a critical challenge: balancing capital returns with reinvestment in innovation, particularly in AI-driven solutions like Data Cloud and Agentforce [6].

Industry Comparisons and Competitive Pressures

Salesforce’s strategy contrasts sharply with that of ServiceNow, a key rival in the cloud software sector. While Salesforce has initiated dividends and expanded buybacks, ServiceNow has opted for its first-ever buyback program without a dividend, focusing instead on organic growth and AI integration [5]. Analysts argue that ServiceNow’s faster revenue growth and stronger positioning in generative AI make it a more compelling investment [5].

Valuation metrics further complicate the comparison. As of early 2025, Salesforce traded at 20.96 times forward earnings, significantly lower than Microsoft’s 31.26 and Oracle’s 30.84 [4]. While some view this as an undervaluation opportunity, others caution that Salesforce’s reliance on buybacks may mask underlying structural challenges, such as delayed AI monetization and rising competition from niche players [7].

Market Dynamics and Analyst Perspectives

Evolving macroeconomic conditions add another layer of complexity. J.P. Morgan Research notes that U.S. trade policy shifts and global growth dispersion could pressure capital returns, particularly for tech firms reliant on long-term innovation cycles [8]. Meanwhile, BlackRock’s capital market assumptions highlight the potential for an AI-driven productivity boom to cool inflation and boost growth—a scenario that could benefit companies like Salesforce if they successfully scale AI offerings [9].

However, emerging markets and private equity trends suggest a broader reallocation of capital. J.P. Morgan forecasts a slowdown in emerging market (EM) growth to 2.4% in late 2025, with central banks likely to cut rates despite U.S. policy stagnation [8]. This environment may divert investor attention from large-cap tech stocks to higher-yield alternatives, testing the durability of Salesforce’s capital return strategy.

The Verdict: A Step Forward, But Not the Finish Line

Salesforce’s dividend and buyback program demonstrates a clear intent to prioritize shareholder value. The $50 billion repurchase authorization, coupled with a 10% revenue growth rate, positions the company to deliver near-term EPS expansion. However, the effectiveness of these measures hinges on two critical factors:

1. Execution in AI: Can Salesforce’s Agentforce and Data Cloud initiatives translate into sustainable revenue streams, or will they face the same monetization delays plaguing other AI adopters?

2. Competitive Resilience: In a market where ServiceNow and others are outpacing growth metrics, will buybacks and dividends alone suffice to retain investor confidence?

Source:

[1] Salesforce Reports Record Second Quarter Fiscal 2026 Results [https://investor.salesforce.com/news/news-details/2025/Salesforce-Reports-Record-Second-Quarter-Fiscal-2026-Results/default.aspx]

[2] Salesforce: The Market Got It Wrong [https://seekingalpha.com/article/4819355-salesforce-market-got-it-wrong]

[3] Salesforce Q2 FY 2026 Earnings Show CRPO & Margin Expansion [https://futurumgroup.com/insights/salesforce-q2-fy-2026-earnings-show-eps-beat-crpo-growth-margin-expansion/]

[4] Better Cloud Stock: Salesforce vs. ServiceNow [https://www.nasdaq.com/articles/better-cloud-stock-salesforce-vs-servicenow]

[5] Salesforce Is Overvalued & ServiceNow Is Poised to Successfully Steal Market…

Source link